Affordable Bankruptcy Lawyer Tulsa Fundamentals Explained

Table of ContentsA Biased View of Chapter 7 - Bankruptcy BasicsTulsa Ok Bankruptcy Attorney Things To Know Before You BuySome Known Details About Tulsa Bankruptcy Filing Assistance The Ultimate Guide To Bankruptcy Attorney TulsaGetting My Experienced Bankruptcy Lawyer Tulsa To Work

The stats for the other primary kind, Chapter 13, are even worse for pro se filers. Suffice it to say, talk with an attorney or two near you that's experienced with personal bankruptcy law.Many lawyers additionally supply complimentary appointments or email Q&A s. Take benefit of that. Ask them if insolvency is certainly the best selection for your scenario and whether they think you'll qualify.

Advertisements by Money. We might be compensated if you click this ad. Advertisement Since you've decided personal bankruptcy is indeed the best strategy and you ideally cleared it with a lawyer you'll require to start on the documentation. Prior to you dive right into all the main insolvency types, you ought to get your very own documents in order.

Little Known Questions About Chapter 7 - Bankruptcy Basics.

Later down the line, you'll in fact need to verify that by revealing all kind of information regarding your monetary affairs. Here's a standard listing of what you'll require when traveling ahead: Determining records like your driver's permit and Social Protection card Income tax return (up to the previous 4 years) Proof of revenue (pay stubs, W-2s, independent profits, income from properties in addition to any type of income from government benefits) Financial institution declarations and/or retirement account declarations Proof of value of your assets, such as car and real estate evaluation.

You'll desire to comprehend what kind of financial obligation you're trying to resolve. Debts like youngster assistance, alimony and specific tax financial obligations can't be discharged (and bankruptcy can't stop wage garnishment pertaining to those financial debts). Student lending debt, on the various other hand, is not impossible to discharge, however keep in mind that it is hard to do so (bankruptcy attorney Tulsa).

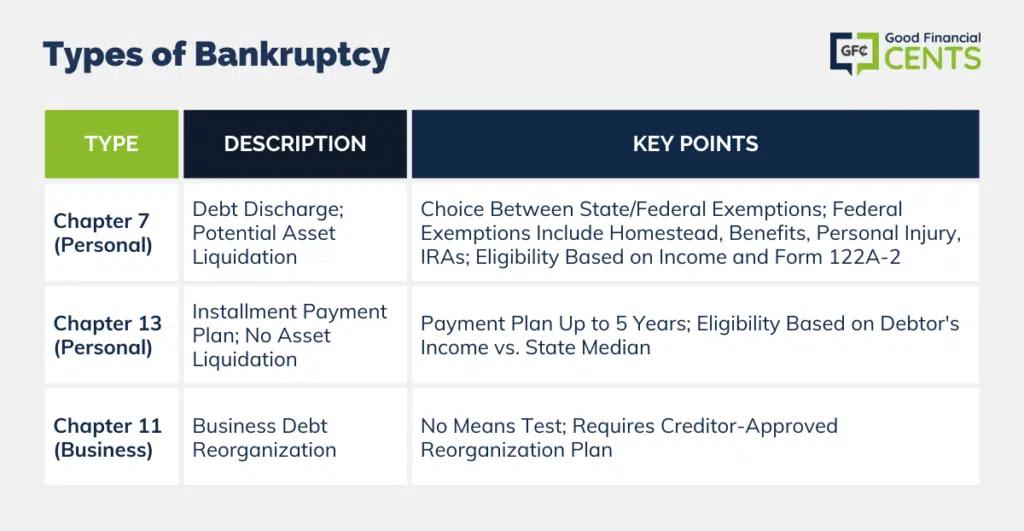

You'll desire to comprehend what kind of financial obligation you're trying to resolve. Debts like youngster assistance, alimony and specific tax financial obligations can't be discharged (and bankruptcy can't stop wage garnishment pertaining to those financial debts). Student lending debt, on the various other hand, is not impossible to discharge, however keep in mind that it is hard to do so (bankruptcy attorney Tulsa).If your earnings is expensive, you have an additional choice: Chapter 13. This choice takes longer to settle your financial obligations since it needs a long-term repayment plan usually three to 5 years before some of your staying financial obligations are wiped away. The declaring process is additionally a whole lot much more intricate than Chapter 7.

Some Known Details About Tulsa Bankruptcy Lawyer

A Phase 7 bankruptcy remains on your credit rating record for one decade, whereas a Phase 13 insolvency diminishes after 7. Both have enduring influence on your credit history, and any new financial debt you try this out take out will likely include greater passion prices. Before you submit your bankruptcy kinds, you should initially complete a required course from a credit scores therapy firm that has actually been authorized by the Division of Justice (with the significant exception of filers in Alabama or North Carolina).

The course can be completed online, in person or over the phone. You have to finish the training course within 180 days of declaring for personal bankruptcy.

Our Affordable Bankruptcy Lawyer Tulsa PDFs

Check that you're submitting with the proper one based on where you live. If your long-term residence has relocated within 180 days of loading, you must submit in the district where you lived the better section of that 180-day period.

Normally, your bankruptcy attorney will certainly work with the trustee, however you might need to send out the individual documents such as pay stubs, tax returns, and checking account and credit report card declarations directly. The trustee who was simply selected to your situation will quickly establish a mandatory conference with you, Tulsa bankruptcy attorney called the "341 conference" due to the fact that it's a demand of Area 341 of the U.S

You will certainly need to supply a timely checklist of what qualifies as an exception. Exemptions might put on non-luxury, key lorries; necessary home products; and home equity (though these exceptions rules can vary widely by state). Any building outside the checklist of exemptions is thought about nonexempt, and if you do not provide any type of checklist, then all your property is thought about nonexempt, i.e.

You will certainly need to supply a timely checklist of what qualifies as an exception. Exemptions might put on non-luxury, key lorries; necessary home products; and home equity (though these exceptions rules can vary widely by state). Any building outside the checklist of exemptions is thought about nonexempt, and if you do not provide any type of checklist, then all your property is thought about nonexempt, i.e.The trustee would not offer your cars to instantly repay the creditor. Rather, you would certainly pay your lenders that quantity throughout your payment strategy. A common misconception with bankruptcy is that when you submit, you can stop paying your financial obligations. While insolvency can help you erase a number of your unprotected financial obligations, such as overdue clinical bills or individual finances, you'll intend to keep paying your monthly repayments for protected financial obligations if you intend to maintain the residential or commercial property.

Our Tulsa Bankruptcy Filing Assistance Diaries

If you go to risk of repossession and have tired all various other financial-relief options, then applying for Phase 13 might delay the repossession and conserve your home. Ultimately, you will still need the earnings to continue making future home mortgage repayments, along with settling any late payments throughout your settlement strategy.

If so, you might be required to offer extra details. The audit can postpone any financial debt alleviation by numerous weeks. Naturally, if the audit turns up incorrect info, your case can be disregarded. All that said, these are rather unusual circumstances. That you made it this far at the same time is a decent sign a minimum of several of your financial obligations are qualified for discharge.